As a growth company, Apple is expected to generate value and profits – not today, but in the future, because it is innovative. The inability to deliver immediate results means that growth stocks do not pay dividends. Instead, investors expect the stock price to go up when earnings come. Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets.

It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers. Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California.

Apple's stock closed at an all-time high price of $144.57 on Wednesday and continues to extend its gains this week, reaching a new intraday high above $145 in trading today. Apple shares have risen around 17% since the start of June. The stock market gains come ahead of Apple's third quarter earnings results, which will be reported on July 27. Apple unveiled several new products during the... Nothing in our research constitutes legal, accounting or tax advice or individually tailored investment advice.

Our research is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive or obtain access to it. Our research is based on sources that we believe to be reliable. Some discussions contain forward looking statements which are based on current expectations and differences can be expected. Further, we expressly disclaim any responsibility to update such research. Past performance is not a guarantee of future results, and a loss of original capital may occur.

None of the information presented should be construed as an offer to sell or buy any particular security. As always, use your best judgment when investing. Rose 34% last year and has pulled back $10 this week from all-time highs due to the tech meltdown.

Expected to give only 2-3% earnings growth, but it usually surprises. Last year it suffered supply chain delays, but that should be a tailwind this year, including China. Apple has a massive customer base of 1 billion.

Services make up 19% of total sales and will grow a lot, and services offer much higher margins than sales. It's the best consumer products company in the world. Pays a small dividend, but buys a huge number of shares.

Will Apple Stock Rise Tomorrow Apple's stock price closed at an all-time high of $139.07 today after reaching a new intraday record of $139.85 moments earlier. The gains come just five days before Apple is set to report its earnings results for the first quarter of the 2021 fiscal year. Many analysts forecast that Apple's quarterly revenue will exceed the $100 billion mark for the first time thanks to strong iPhone 12... MarketBeat empowers individual investors to make better trading decisions by providing real-time financial data and objective market analysis. Just as Apple's market capitalization hits the $3 trillion milestone, its share price as a percentage of the Nasdaq 100 index's value is bumping up against a key technical level. In recent prior times, the stock price has risen above such a level and then subsequently declined.

Just two days after becoming a $2 trillion company, Apple continues to experience impressive momentum on the stock market, with shares in the company rising around four percent in intraday trading as of writing. Apple's stock price is quickly closing in on the $500 mark and has more than doubled since bottoming out at $224 in late March. Despite the global health crisis, the company set a... After becoming the first U.S. company to reach a market capitalization of $2 trillion last week, Apple's stock continues to soar as investors pour money into the company.

Apple's stock officially opened this morning above the $500 mark, up another 3.5% to $515. Apple and other tech heavyweights have seen their share prices rise significantly since market lows in March, with Apple more than... Apple's four-for-one stock split takes effect today, with the company's share price dropping from roughly $500 to around $125 as of the start of trading this morning.

The strong rise in Apple's stock price over the past five months has continued today, with shares trading nearly 3% higher in the first few minutes of trading. Apple shares have pared their gains since then, but are still up... Apple briefly became the world's first $3 trillion company today based on market capitalization, which is the total value of all of the company's outstanding shares. The milestone came after Apple's stock price rose over 40% in the last year.

The impressive feat, which Apple achieved when its stock price reached the $182.86 mark during intraday trading, came just over 16 months after Apple be... Following several months of explosive growth, Apple's stock came crashing down on Thursday, dropping around eight percent in a single day. It was the worst day of trading for technology stocks as a whole since March. Apple's market capitalization slid over $180 billion as a result of the sell-off, marking the largest one-day loss in value for any company ever, according to Barron's. Apple's currently quarterly revenue record is $91.8 billion, set in the first quarter of the 2020 fiscal year.

In an investor note shared with MacRumors, Monness Crespi... Moody's Daily Credit Risk Score is a 1-10 score of a company's credit risk, based on an analysis of the firm's balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. Updated daily, it takes into account day-to-day movements in market value compared to a company's liability structure.

31 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Apple in the last year. There are currently 1 sell rating, 5 hold ratings, 23 buy ratings and 2 strong buy ratings for the stock. The consensus among Wall Street research analysts is that investors should "buy" Apple stock. View analyst ratings for Apple or view top-rated stocks.

"September is historically a tough month, and the first week was not a good sign," says Anthony Denier, CEO of trading platform Webull. Transactions in the international currency market Forex contain a high level of risk. Only speculate with money that you can afford to lose. All stock prices, indices, futures are indicative and should not rely on trade. The portal allforecast.com does not accept any liability for any loss that you may incur as a result of using this data.

Gold prices were flat on Tuesday, as markets anticipated quicker rate hikes based on key December U.S. inflation data due later this week, while stronger bond yields continued to cap gains. Spot gold was little changed at $1,803.29 per ounce by 0017 GMT. U.S. gold futures were up 0.2% to $1,802.20. Alternatively, assess the AAPL premarket stock price ahead of the market session or view the after hours quote.

View the Apple Inc real time stock price chart below to monitor the latest movements. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the AAPL quote. Apple's stock opened at a new all-time high of $138.05 today, eclipsing the company's previous opening record of $137.59 set on September 2, 2020. However, the share price has since trended downwards slightly in intraday trading. Apple has seen its stock price rise nearly 150% since opening at a 2020 low of $57.02 in late March, a few weeks after COVID-19 was declared a pandemic by the World ...

What's more, it is also possible that rising optimism over an economic rebound may see investors funnel some money out of tech stocks in the months ahead. An analysis of stocks based on price performance, financials, the Piotroski score and shareholding. Find out how a company stacks up against peers and within the sector. As a result, on a day when lots of Apple options are expiring at a strike price of $500, options investors were also likely buying and selling Apple stock around that level, as well.

And, indeed, trading in Apple stock picked up in the final hour today until finally settling at precisely $500. That's probably because so many options traders were on both sides of the bet that Apple would end up above or below $500. This is called strike pinning, and it's increasingly common as trading in stock options grows more popular. If you do want to invest in a headline stock in EV's then consider Apple. The maker of iPhones—it's long been reported—plans to build self-driving EV's.

We all know of Apple's long track record of building innovative products, such as the iPod and the tablet, so they've earned the confidence of the market to succeed in EV's. Some readers will swear by Tesla, and I can't argue against its magnificent stock performance in past years, but Apple offers far less volatility. Read 4 Popular Headline Stocks for our full analysis. So, we are clear that the stock would likely break the $200 level in 2022 as the excitement surrounding its AR/VR launch gets closers, coupled with its services segment revenue growth in its earnings releases.

As a result, we believe that AAPL's stock price could be re-rated to reflect its potential over the next year. Morgan Stanley analyst Katy Huberty today raised her services-related revenue forecast for Apple through the 2022 fiscal year. The New York Times last year reported that... On December 12, 1980, Apple stock began trading on the Nasdaq at $22 per share.

Steve Jobs, the largest shareholder, made $217 million on the first day of trading. By the end of trading on that Friday afternoon, Apple's stock price had risen by almost 32%, closing near a stock price of $29 and resulting in a market value of $1.778 billion for Apple. StockInvest.us is a research service that provides financial data and technical analysis of publicly traded stocks. All users should speak with their financial advisor before buying or selling any securities. Users should not base their investment decision upon StockInvest.us.

By using the site you agree and are held liable for your own investment decisions and agree to the Terms of Use and Privacy Policy.Please read the full disclaimer here. The pandemic has propelled Apple's sales as many turned to the brand's products either for work, study or to socialise. The economic uncertainty that prevailed during the first year of the pandemic also saw investors flock to tech stocks, traditionally viewed as safety stocks during periods of larger economic turbulence.

Wedbush analyst Daniel Ives, whose price target for Apple is a Street-high $175, also sees a $3 trillion valuation on the horizon. AAPL stock has been languishing since stellar results at the end of April. Apple shares traded up to $137 immediately after that earnings release. Those results were prettystellar, coming in 40% higher than the average Wall Street analyst forecast.

Apple also upped its buyback program as well as increasing its dividend. However, as mentioned, May was a tricky month for the Nasdaq, and Apple suffered as the month wore on, slipping to $122. June has been kinder to AAPL stock with the shares finally seeing some bid action and pushing steadily back to test key resistance levels, the next test coming at $137. From the past average forecast of $156.84, 6 months ago from 37 wall street analysts. Ahead of tomorrow's AAPL Q earnings report, analysts are expecting good news.

The Wall Street consensus is that the Cupertino company will report fiscal Q3/calendar Q2 revenue of $72.93B – up from 59.69B in the same quarter last year. On the first day of trading in 2022, the Silicon Valley company's shares hit an intraday record high of $182.88, putting Apple's market value just above $3 trillion. The stock ended the session up 2.5% at $182.01, with Apple's market capitalization at $2.99 trillion. Apple is the perfect example of the stock market today.

They just delivered a strong quarter, but suffered revenues shortfalls from the chip shortage. The street is dead wrong about Apple and sold it off today. Apple products are excellent and will remain in demand.

Apple is the 5th-largest economy in the world, he says without sarcasm. For a generation holding onto stocks longer than expected (because bonds don't pay like they used to ), Apple is the exact asset to replace fixed income. It has ridiculous free cash flow and boasts double-digit revenue growth and profit expansion. It's up 25% this quarter so far and up 8% this month so far. Ahead of the budget, the government is looking at providing capital gains exemption to shares of Indian companies that are listed directly on overseas stock exchanges.

The move is similar to the norms that are applicable to depository receipts . As a growth-oriented investor myself, I am aware of the challenges investors face in their quest to find the right growth stocks. There are so many high-potential companies in the market.

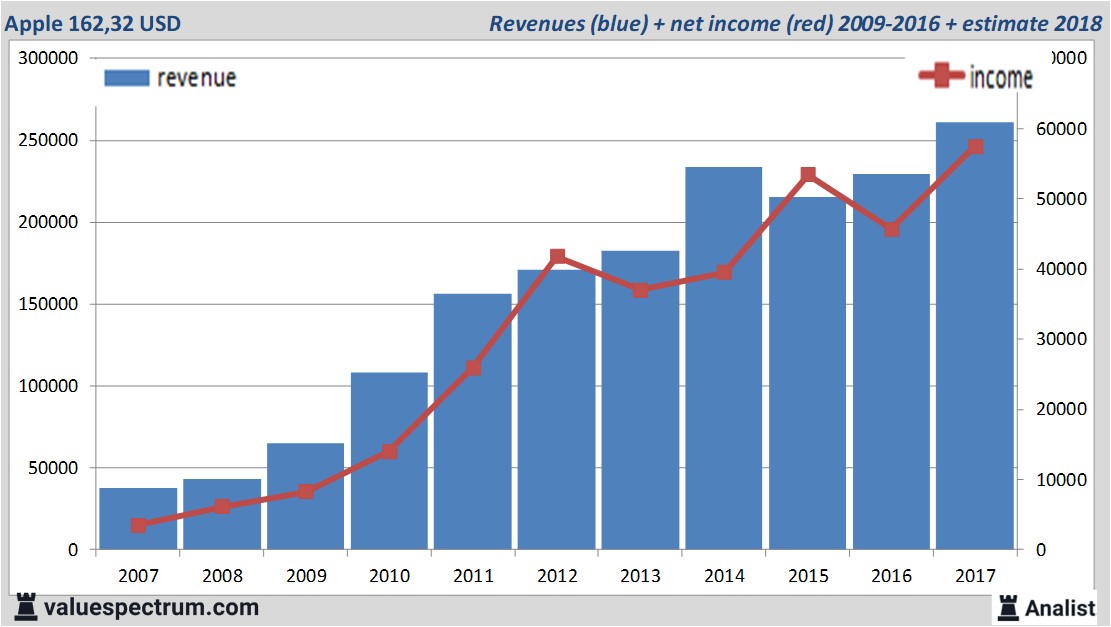

As these are emerging leaders, the due diligence required is even more crucial. All growth investors want multi-bagger returns. Unfortunately, most could hardly find the time to do the necessary work. Apple bears have often pointed out the deceleration in the company's topline growth as proof of a stock that is massively overvalued. Readers can refer to the chart above, where Apple's revenue growth is estimated to decelerate over the next three years. Consensus estimates point to a revenue CAGR of just 4.6% through FY24.